Key Takeaways:

- Do not click on links or download attachments from suspicious emails; they may contain malware.

- Check the sender’s email address carefully; official emails from Chase will come from a trusted domain.

- Forward any suspicious emails to Chase’s official support for verification and mark them as spam to prevent future scams.

Did you know that phishing attacks, like Chase spam emails, account for 90% of all data breaches? With cybercriminals becoming increasingly sophisticated, it is essential to stay vigilant.

Financial institutions like Chase Bank are prime targets for these scams due to the wealth of personal and banking information associated with their clients.

According to the Anti-Phishing Working Group, nearly 1 in 5 phishing emails impersonate trusted financial brands, and Chase consistently ranks as one of the most spoofed companies.

What’s even more alarming is the effectiveness of these common scams. Research indicates that over 30% of people open phishing emails, and a staggering 12% click on the links within. This puts sensitive data—like bank account numbers, Social Security numbers, and login credentials—at risk of falling into the hands of cybercriminals.

As the methods used by scammers become more sophisticated, recognising and protecting yourself from these malicious attempts is more important than ever in digital life.

In this article, we’ll explore how to spot Chase spam emails, what to do if you receive one, and key strategies to protect your personal and financial information from falling into the wrong hands. Stay alert, stay informed, and stay banking safer!

Protect Your Brand & Recover Revenue With Bytescare's Brand Protection software

What Are Chase Spam Emails?

Chase spam emails are fraudulent messages designed to deceive recipients into providing personal, financial, or sensitive information. These emails often impersonate Chase Bank or its affiliates, using official-looking logos, branding, and language to appear legitimate.

The goal of these spam emails is to trick individuals into clicking on malicious email links, downloading harmful attachments, or revealing login credentials, bank account numbers, or credit card information.

Phishing attacks, which are the type of scam behind Chase Bank spam emails, usually involve messages that are urgent.

For instance, a fake email might say that your Chase account has been hacked and ask you to click a link to “verify your information.” Often, these links take you to fake websites that look like the Chase login page, where you enter your personal information unknowingly.

Another common tactic used in Chase spam emails is fake account or transaction alerts. The email might say that your account has been charged or that suspicious activity has been detected, urging you to act quickly and provide personal details to resolve the issue.

People fall for these types of scams because they play on the sense of urgency, which makes it easy for them to act quickly without reading the email.

It’s important to recognise the signs of Chase spam emails, such as misspelt words, unfamiliar sender addresses, or requests for personal information. As long as you confirm emails through official channels, you can avoid falling for these dangerous scams.

Why Are Chase Customers Targeted?

Cybercriminals prefer to target Chase users because of the bank’s large customer base. Scammers know that with millions of account users as well as substantial assets, there is a lot of private information they can use.

If scammers impersonate Chase, they have a better chance of convincing customers to give them personal information like account numbers or Social Security numbers.

Chase customers also have access to large amounts of money, which makes them more appealing to impersonators who want to make money.

The trustworthiness of the bank makes phishing attempts more likely to work because people tend to open emails that look like they came from a trusted source.

As a result, fraudsters constantly refine their tactics to create convincing messages that manipulate emotions like urgency and fear, making it critical for customers to stay vigilant.

How to Spot Red Flags in Chase Spam Emails?

| Suspicious Sender Address | The sender’s email address might look much like Chase’s official address with a few differences. |

| Generic Greetings | These emails don’t address you by name; instead, they use generic phrases like “Dear Customer.” |

| Urgent or Alarming Language | Phrases like “Immediate action required” or “Your account is at risk” are meant to create panic. |

| Unsolicited Attachments/Links | They may include attachments or links that, when clicked, can lead to phishing sites or malware. |

| Spelling and Grammar Errors | Many spam emails contain errors in spelling, grammar, or punctuation, which are uncommon in official communications. |

| Unfamiliar Requests for Personal Information | Legitimate emails from Chase will never ask for sensitive information like your password or account number via email. |

| Unusual Account Activity Claims | They might falsely claim suspicious activity or fraudulent charges to trick you into acting quickly. |

| Suspicious Domain Names | The email domain may appear similar to Chase’s, but with slight misspellings or odd characters. |

Protect Your Brand & Recover Revenue With Bytescare's Brand Protection software

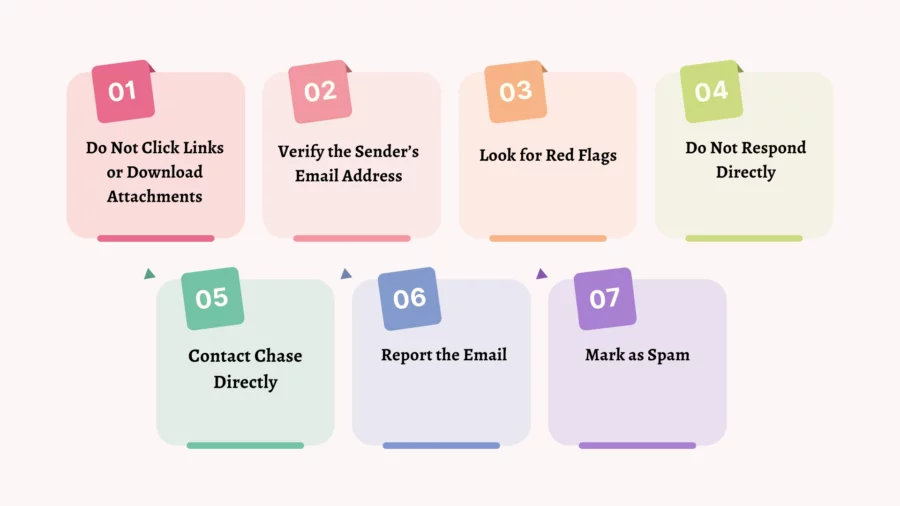

What to Do If You Receive a Suspicious Email?

If you receive a suspicious email claiming to be from Chase, it’s important to stay calm and take the right steps to protect yourself from potential scams. Here’s what you should do:

Do Not Click Links or Download Attachments

Do not open any links or download any files attached to the email. These could take you to dangerous websites or install malware on your device.

Verify the Sender’s Email Address

Check the sender’s email address closely. Emails from Chase will come from a trusted domain, like @chase.com. If the domain is incorrect, it is likely a scam email.

Look for Red Flags

Watch out for emails that sound urgent, have grammatical errors, or ask for private information like your account number or Social Security number.

Do Not Respond Directly

Do not reply to the email or converse with the person who sent it. The scammers might try to keep talking to get more information.

Contact Chase Directly

If the email says it’s from Chase, call the bank’s customer service number directly. Don’t use any of the contact details in the suspicious email.

Report the Email

Forward the suspicious email to Chase’s official support team. Additionally, you can report it to the Federal Trade Commission (FTC) or your email provider.

Mark as Spam

Mark the email as spam or junk in your email client to prevent future emails from the same sender.

Differences Between Legitimate and Spam Emails

| Legitimate Emails | Spam Emails |

| Comes from an official, trusted domain (e.g., @chase.com) | Often uses a slightly altered or suspicious domain name |

| Personalised, using your name or account details | Generic greeting like “Dear Customer” or “Dear User” |

| Clear, relevant, and directly related to your account or service | Often urgent, alarming, or too good to be true (e.g., “Account Suspended”) |

| Professional and consistent with previous communications | Often uses urgent, threatening, or overly promotional language |

| Will never ask for sensitive information via email (e.g., password, Social Security number) | Frequently requests sensitive information (e.g., passwords, bank details) |

| Links lead to trusted websites and official pages | Links may lead to suspicious or fraudulent websites |

| Attachments are usually from trusted sources and expected | Often contains unsolicited or unexpected attachments |

| Free from spelling or grammatical mistakes | Contains noticeable errors in spelling, grammar, or punctuation |

| Consistent with the brand’s official style and design | May appear unprofessional or poorly designed |

| Clear, legitimate action required based on your account activity | Often asks for immediate action to avoid consequences (e.g., account suspension) |

Protect Your Brand & Recover Revenue With Bytescare's Brand Protection software

How to Report Chase Spam Emails?

It’s important to report any suspicious email that claims to be from Chase to keep yourself safe from potential fraud. Here is the effective way to report Chase spam emails:

Forward the Email to Chase

The first thing that needs to be done is to send the suspicious email to Chase’s official abuse email address. This lets the bank’s fraud team take appropriate steps.

Report to the Federal Trade Commission (FTC)

You can also report phishing attempts to the FTC through their website. The FTC keeps an eye on fraudulent activities while utilising this information to help prevent more scams.

Notify Your Email Provider

Most email platforms let you mark an email as spam. If you report the email to your email provider, it will help prevent other users from getting similar phishing attempts.

Report to the Anti-Phishing Working Group (APWG)

The APWG is an international coalition dedicated to eliminating fraud and identity theft. You can forward phishing emails to their reporting system.

Block the Sender

You should block the sender’s email address in your email client after you report the email. This makes it less likely that the same source will send you texts in the future.

By reporting suspicious emails, you not only help keep your own information safe but also help stop phishing scams from spreading. Check any email that seems fishy, even if it looks like it came from someone you trust, like Chase.

Examples of Chase Spam Emails

Chase spam emails are deceptive messages that are made to look like they are from the real Chase Bank. They usually try to get people to give out personal information or make fraudulent transactions.

These emails look like they came from the bank, but they contain suspicious online activities. Here are a few examples:

Account Lock Warning

- A common spam email claims that your Chase account has been locked due to suspicious activity.

- The email urges you to click on a link to “unlock” your account by entering your personal details or login information.

- Often, the link leads to a fake website that steals your credentials.

Fake Rewards Offer

- Another common spam involves fraudulent reward programs, claiming that you’ve earned points or cash back.

- The email asks you to click on a link to claim your rewards, leading you to a phishing website where you’re asked for your account number and other sensitive details.

Tax Refund Scam

- Scammers send emails stating that you are eligible for a tax refund through Chase.

- The email instructs you to provide personal or banking details to “process the refund.”

- Clicking the link may download malware or direct you to a fake Chase page to steal your data.

Loan Offers

- Some Chase spam emails offer quick loans or financial relief, often in response to “unpaid debts” or “recent transactions.”

- These emails ask for immediate action, like clicking on links to apply for the loan or updating personal information.

What Are the Consequences of Chase Spam Emails?

The consequences of falling for Chase spam emails can be severe, both financially and personally. These deceptive emails are designed to trick recipients into revealing sensitive information, such as login credentials, credit card details, or Social Security numbers, which scammers can exploit in various ways.

Financial Loss

If a victim unknowingly provides their debit card or credit card details, bad actors can access their accounts and commit financial fraud. This can lead to significant financial abuse, especially if the victim does not notice fraudulent activity immediately.

Identity Theft

Chase spam emails often ask for personal information, such as Social Security numbers or full names. If provided, this data can be used by cybercriminals to steal the victim’s identity, opening new credit accounts, applying for loans, or engaging in other forms of fraud in the victim’s name.

Data Breaches

Clicking on links or downloading attachments in a phishing email can lead to malware or spyware being installed on your device. This software can collect your personal data and send it back to cybercriminals, further exposing you to potential theft.

Damage to Credit Score

Fraudulent activities, such as opening new accounts in your name or missing payments on loans taken out using your identity, can damage your Chase credit journey. This can take years to recover from and may lead to higher interest rates or difficulty obtaining loans in the future.

Emotional Stress

Recovering from a phishing attack can be a time-consuming and emotionally draining process. Victims may face stress in dealing with financial institutions, restoring their credit, and securing their personal information.

How Can You Protect Yourself from Future Email Scams?

Protecting yourself from future email scams, such as those claiming to be from Chase, requires vigilance and adopting good security practices. Here are effective safety practices to protect your personal information:

Verify the Sender

- Always double-check the sender’s email address.

- Phishing emails often use addresses that look similar to official ones but contain subtle differences, like extra letters or numbers.

- For example, a legitimate Chase email will come from an official domain like “@chase.com.”

Avoid Clicking Links or Downloading Attachments

- Do not click on links or download malicious attachments in unsolicited emails.

- Hover your mouse over links to see the true destination URL.

- For example, an email claiming to be from Chase might direct you to a fake website designed to steal your credentials.

Use Multi-Factor Authentication (MFA)

- Enable MFA on your bank accounts and other important online services.

- MFA adds an extra layer of security by requiring a second form of identification, such as a code sent to your phone, in addition to your password.

Update Your Software Regularly

Keep your operating system, web browser, and antivirus software up to date to protect against known vulnerabilities that hackers might exploit.

Monitor Your Accounts

- Regularly check your bank statements and credit reports for suspicious activity.

- Early detection of unauthorised transactions can minimise damage.

Educate Yourself and Others

- Stay informed about the latest phishing tactics.

- Share this knowledge with friends and family to help prevent them from falling victim to scams as well.

Tools and Techniques to Verify Authenticity

| Tool/Technique | Description | How It Helps |

| Check the Sender’s Email Address | Inspect the sender’s email for misspellings or unusual domains. | Scammers often use similar-looking addresses to appear legitimate. |

| Hover Over Links | Hover your mouse over any links without clicking to reveal the actual URL. | This makes sure that the link goes to a legitimate website and not a fake page. |

| Use Anti-Phishing Tools | To find phishing websites, use security tools like McAfee or Norton. | Real-time alerts from these tools help you stay away from fake websites where you might enter personal information. |

| Verify via Official Website | To check for alerts, don’t click on links; instead, go to the official website. | To avoid being redirected to fake websites, this makes sure you’re on the right website. |

| Use Multi-Factor Authentication | Enable MFA on your accounts for added security. | It gives you extra security and makes it harder for scammers to get into your accounts. |

| Contact the Company Directly | To check if an email is real, use official company contact details to get in touch with the legitimate company. | Direct verification keeps you safe from phishing traps. |

| Use Email Authentication Tools | Tools like DMARC, SPF, and DKIM help verify if an email is coming from a trusted source. | If an email looks like it came from authorised domains, these security methods can help find email spoofing. |

What’s Next?

Chase email scams pose significant risks, from financial loss and identity theft to emotional distress. These deceptive emails often appear legitimate, tricking recipients into sharing sensitive information or clicking on malicious software.

To protect your online accounts, always verify the sender’s email address, avoid clicking on suspicious links, and use multi-factor authentication for added security. Regularly monitor your accounts and stay updated on the latest phishing tactics.

By employing tools like anti-phishing software, checking URLs, and verifying directly through official websites, you can effectively reduce the chances of falling victim to these phishing email scams. Awareness and caution are key to safeguarding your personal and financial information from fraudulent email threats.

Bytescare Brand Protection offers global brand integrity, extending coverage across major social media platforms. Overcome jurisdictional limitations with real-time access to a customisable dashboard, ensuring effective digital safety.

Protect your brand and gain a competitive edge. Contact us today to secure your brand and maintain control!

The Most Widely Used Brand Protection Software

Find, track, and remove counterfeit listings and sellers with Bytescare Brand Protection software

FAQs

What Should I Do if I Accidentally Click a Link in a Chase Spam Email?

Immediately change your Chase account password and enable multi-factor authentication. Monitor your account for suspicious activity and contact Chase Bank customer support to report the incident for further guidance.

How does Chase notify you of suspicious activity?

Chase Bank typically sends alerts via email, text, or the mobile app if suspicious transactions or login attempts are detected. These alerts provide details of the suspicious activity and may prompt you to verify or secure your account.

How do I know if my Chase alert is real?

Verify the sender’s email address or phone number. Genuine Chase Bank alerts come from official sources like “@chase.com.” Avoid clicking links or providing personal information. Instead, log in to your account directly or call Chase to confirm.

How can you report spam Chase emails?

Forward phishing emails with evidence of fraud to Chase’s fraud department at abuse@chase.com. You can also report spam through your email provider by marking it as phishing or junk to help block future bank text message scams.

What are Chase email spam’s common phrases and triggers?

Common phrases in phishing email scam include “account has been locked,” “urgent action required,” “verify your identity,” or “you’ve won rewards.” Be cautious of fake bank email messages with poor grammar, unfamiliar links, and unexpected requests for personal information.

What steps to take when you receive a suspicious email?

Do not click any links or download malicious attachments. Verify the sender’s email, and contact Chase directly via their official website or customer support. Report the suspicious email to Chase and your email provider.

Ready to Secure Your Online Presence?

You are at the right place, contact us to know more.