Key Takeaways:

- Chase alert spam texts mimic legitimate notifications to steal personal data; always verify links before clicking or responding.

- Fraudulent texts create urgency. Pause and contact Chase directly through official channels to confirm suspicious messages.

- Never share banking details via text. Use Chase’s secure app or website for all communications and transactions.

Mobile banking has become the norm, with over 65% of banking customers using apps and SMS notifications to monitor their finances. While these conveniences offer quick access to accounts and instant updates, they also open the door to new security threats.

One of the most prevalent dangers is Chase alert text message spam. These fraudulent messages cleverly mimic official bank alerts, attempting to trick users into sharing sensitive information or clicking malicious links.

Shockingly, studies show that nearly 98% of SMS messages are read within three minutes, making text scams highly effective for cybercriminals seeking to exploit quick reactions.

Phishing attacks via text messages, often called “smishing,” have seen a dramatic increase in recent years, with financial institutions being one of the top targets. Reports indicate that phishing scams affected over 75% of organisations in the last year, and losses from such scams reached billions globally.

For Chase customers, knowing how to identify and respond to fake alert texts is essential to protecting personal data and financial assets. This guide outlines the essentials that will help you stay alert and safeguard against potential scams, ensuring your banking experience remains safe and secure.

Protect Your Brand & Recover Revenue With Bytescare's Brand Protection software

What Is Chase Alert Text Message Spam?

Chase alert text message spam, commonly known as “smishing,” is a type of phishing scam where fraudulent text messages impersonate official notifications from Chase Bank.

These messages are crafted to look legitimate, using Chase’s branding or similar wording to deceive recipients into believing they are real account alerts.

Common examples include fake notifications about unauthorised account access, fake transactions, or urgent security updates that prompt users to act quickly.

The objective of these scams is to trick users into sharing personal information, such as account numbers, passwords, or Social Security numbers. They often contain links to fraudulent websites that mimic Chase’s actual site, asking users to log in or verify sensitive data.

Clicking on these links or responding with personal details can lead to identity theft, unauthorised access to accounts, or financial loss.

Smishing has become increasingly sophisticated, and scammers continually evolve their tactics to appear more convincing. According to recent cybersecurity reports, smishing attacks have increased by over 30% in the past year, with banking institutions among the most targeted sectors.

To protect yourself, never click on links or provide personal information in response to unsolicited texts. If you receive a suspicious text claiming to be from Chase, it’s best to ignore it and contact Chase directly through their official channels to verify the message.

Ensuring that your phone’s software is up-to-date and using security features, such as two-factor authentication, can also help safeguard against these scams.

How Does Chase Alert Text Message Spam Work?

Chase alert text message spam works through a tactic known as “smishing,” where scammers send fake texts designed to look like legitimate alerts from Chase Bank.

These texts typically inform the recipient of urgent matters, such as suspicious account activity, unauthorised transactions, or security breaches. The goal is to create a sense of urgency, prompting the user to click on a malicious link or respond with personal details.

The link usually directs to a counterfeit website that mimics Chase’s official site, asking for login credentials, account numbers, or other sensitive information. Once the user submits this information, scammers can use it to gain unauthorised access to bank accounts, commit identity theft, or steal funds.

Smishing scams often leverage realistic branding and language to appear genuine, tricking even cautious users. To avoid falling victim, never click links in unsolicited texts or share personal data. Always verify through official Chase channels before taking action.

Why Am I Getting Chase Alert Text Message Spam?

Receiving Chase alert text message spam can be alarming and confusing, especially if you don’t have an account with the bank. These fraudulent texts are part of a widespread phishing scheme known as “smishing,” which targets individuals to steal personal or financial information.

However, why are you getting these texts? Because of these things:

Random Targeting by Scammers

- Cybercriminals often use automated software to send mass messages to random phone numbers.

- The goal is to cast a wide net, hoping that at least some recipients will be actual Chase customers or be tricked by the realistic-looking alerts.

Data Breaches and Leaked Information

- If your phone number was leaked online or in a data breach, scammers can easily get it and use it to commit fraud.

- This can happen on social media accounts, unprotected websites, or marketing databases.

Phone Directory Harvesting

- Some scammers use automated systems to generate and send texts to a sequence of phone numbers.

- Even if you’ve never interacted with a scammer before, these messages could still reach you as part of a widespread campaign.

Malware and Phishing Campaigns

If you’ve interacted with suspicious links or apps in the past, your information may be circulated among cybercriminal networks, increasing the chances of receiving fraudulent texts.

To protect yourself, never respond or click on links in suspicious texts. Use spam filters on your device and report the numbers to your carrier or the Federal Trade Commission (FTC). Always stay alert and verify through official Chase channels if you receive a questionable message.

Protect Your Brand & Recover Revenue With Bytescare's Brand Protection software

How Can You Tell It Is a Fraudulent Texts Message from Chase?

It can be hard to tell at first that a Chase spam text message is not a real banking alert because it looks like one. But if you know what they all have in common, you can spot them and avoid falling for one. Here are some important traits:

Urgency and Threats

Chase spam texts often create a sense of urgency, claiming issues like “suspicious online activity,” “unauthorised login attempt,” or “digital payment declined.” The goal is to pressure you to respond quickly without verifying the source.

Unfamiliar Links

These messages have short or suspicious-looking links in them that lead to fake websites that are trying to steal your information. Before clicking on a link, always make sure it leads to Chase’s official website.

Generic Greetings

Unlike legitimate bank messages that may address you by your full name, scam texts often use vague terms like “Dear Customer” or no greeting at all.

Spelling and Grammar Errors

Some scam messages look professional, but a lot of them have grammar or formatting mistakes that make it clear they are not real. This kind of mistake is a sign of a scam.

Requests for Personal Information

No reputable bank, including Chase, will ask for sensitive information like your password, Social Security number, or account details via text. Be careful of any message that asks for this information.

Unverified Numbers or Email Addresses

Rather than official Chase channels, scam texts usually come from unknown phone numbers or email addresses.

Different Types of Chase Alert Text Message Spam

Chase alert text message spam comes in various forms, each designed to deceive you into taking quick action without verifying the legitimacy of the message. Knowing these different types can help you recognise scams and protect your personal information. Here are some of the most common types:

Account Alert Scams

- These texts claim there’s suspicious online activity on your account, such as unauthorised transactions or login attempts.

- They want you to click on a link to verify who you are or keep your account safe.

- The link takes you to a fake Chase login page that intends to steal your username, password, and other personal information.

Payment or Transfer Notifications

- Scammers often pretend to be from Chase when they contact you to tell you that a payment or loan application failed.

- The message might ask you to click a link to resolve the issue, but it redirects you to a phishing site that steals your account information when you attempt to “fix” the problem.

Prize or Reward Scams

- Some spam texts offer enticing rewards, such as free gift cards, cash, or loyalty points, claiming they’re from Chase.

- To claim the reward, the message will ask you for information about your bank account or click a suspicious link that takes you to a fake Chase page.

Security Update Requests

- These messages suggest that your Chase account has been compromised and request an immediate update to your security settings.

- They often include a link that takes you to a fraudulent page where you’re asked for sensitive information.

Protect Your Brand & Recover Revenue With Bytescare's Brand Protection software

Differences between legitimate Chase Message and Scams

| Legitimate Chase Message | Scam Message |

| Sent from an official Chase phone number or short code | Sent from random or unknown numbers, not Chase’s official contact |

| Personalized with your name | Generic greetings like “Dear Customer” or no greeting at all |

| Typically informs of account updates or important information, but not urgent | Creates a false sense of urgency (e.g., “Immediate action required”) |

| Links to Chase’s official website or app | Links to fake websites that resemble Chase’s site but are designed to steal information |

| Chase never asks for sensitive information via text (e.g., passwords or Social Security numbers) | Requests sensitive information like login credentials, passwords, or account numbers |

| Proper spelling and grammar, professional tone | Often contains grammatical mistakes or awkward phrasing |

| Typically informational about account updates, payments, or security alerts | Claims of issues like unauthorised transactions or account suspension, urging quick action |

| No contact info needed; Chase directs you to their secure website or app for further action | Asks you to call a suspicious phone number or reply directly to the text |

How to Report Spam to Chase?

Reporting spam text messages to Chase is an essential step in protecting your information and helping the bank take action against scams. Here’s a step-by-step guide on how to report these suspicious messages:

Do Not Respond or Click

If you receive a text that seems suspicious or fraudulent, do not respond or click any links in the message. Scammers won’t be able to get more details or access your accounts using this method.

Forward the Message

To report the spam text to Chase, forward the message to 7726 (SPAM). This number is a universal spam reporting service supported by most mobile carriers, and it helps Chase and mobile carriers identify and block fraudulent numbers.

Contact Chase Directly

After forwarding the text, contact Chase’s official fraud department to inform them of the incident. You can reach Chase customers support service by calling the number on the back of your debit card or business credit card or visiting their official website.

Delete the Message

After you report the spam, be sure to delete the message from your phone so that you don’t contact with it by mistake again.

Stay Informed

Visit Chase’s security center online for updates on current scams and tips on how to stay protected. This resource can help you recognise new types of fraudulent activity.

Enable Spam Filters

Activate spam filters on your phone to reduce the chances of receiving these types of messages in the future.

Do’s and Don’ts When Receiving Suspicious Messages

| Do’s | Don’ts |

| Check if the message came from an official source. | Do not click on any links in the message, even if they look like legitimate. |

| Use their official website or phone number to get in touch with Chase to confirm the message. | Never reply to the message with personal information or verification codes. |

| Log in to the Chase app or official website to check for any alerts. | Avoid calling any phone numbers provided in the suspicious message. |

| Forward the suspicious text to Chase’s official fraud reporting number or report to your mobile carrier. | Be cautious of messages that pressure you to act immediately. |

| Legitimate messages have proper language and formatting. | Never provide your password, account number, or other personal details via text. |

| Enable spam filters on your phone to reduce unwanted messages. | Avoid opening any attachments that may come with the message. |

What Are the Consequences of Falling for Chase Alert Text Message Spam?

If you fall for Chase alert text message spam, it could have big effects on your finances and safety. These are the main risks that come with these scams:

Unauthorised Access to Your Bank Account

- Scammers can now get into your Chase bank account, which is one of the most instant effects.

- These scammers may transfer money or even lock you out of your own online account once they have your login information.

Financial Loss

- Scammers can make transactions without your permission, which can drain your entire savings.

- Getting back stolen money can be stressful. It may also not be possible to get back all the money that was stolen.

Identity Theft

- Scammers can commit identity theft if you give them more personal information, like your address or Social Security number.

- They might also open new accounts, take out loans, or do other fraudulent activities in your name.

Compromised Personal Information

- Falling for these scams may expose your passwords and other sensitive data.

- If you use the same password across different platforms, scammers could access other accounts, such as email or social media, amplifying the damage.

Credit Score Damage

- Identity theft and unauthorised loans or credit applications can negatively impact your Chase credit journey.

- Repairing your credit accounts after fraudulent activity takes time and can affect your ability to secure loans or credit lines in the future.

Examples of Chase Alert Text Message Spam

Real-life examples of Chase alert text scams illustrate how cunning scammers can be in their attempts to deceive victims. These examples show how important it is to spot alert text scams to keep your information safe:

“Suspicious Activity on Your Account” Alert

A text message that says, “Your Chase account has been flagged for suspicious activity” is a usual example. Click here to secure your account: [link].”

This kind of message is meant to make people feel like they need to act quickly, so they click on the link, which takes them to a fake website that is designed to steal their login credentials.

“Payment Failure” Notification

Another instance is a message stating, “Your recent payment attempt has failed. Please verify your account details immediately to avoid service interruption: [link].” Victims who click the link are redirected to a fake Chase login page where scammers capture their account information.

“Account Suspension Warning”

Scammers send texts like, “Your Chase account has been temporarily suspended due to security issues. Confirm your identity here: [link].” This type of message exploits the fear of being locked out, coercing users into sharing sensitive details.

Fake Rewards Offers

Less urgent but equally deceptive are texts offering fake rewards: “Congratulations! You’ve won a $500 Chase reward. Claim now: [link].” While enticing, these scams trick victims into providing personal and financial information under the guise of claiming a prize.

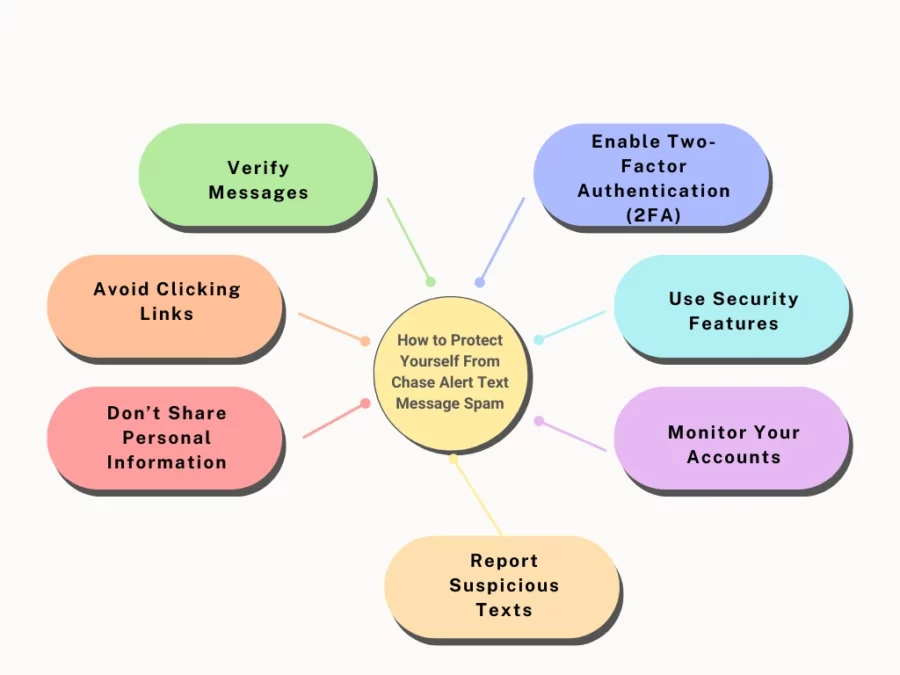

How to Protect Yourself From Chase Alert Text Message Spam?

You need to take effective steps to protect yourself from Chase alert text message spam. To keep your personal information safe and avoid becoming a victim, do the following:

Verify Messages

- Always verify any unexpected or unsolicited text message claiming to be from Chase.

- Contact Chase directly through their official website or phone number if you’re unsure about a message’s legitimacy.

Avoid Clicking Links

- Never click on links included in suspicious text messages.

- Scammers often use these to redirect you to fake sites that mimic Chase’s appearance, intending to steal your login credentials and personal data.

Don’t Share Personal Information

- Chase will never ask for your passwords, Social Security number, or account details through text messages.

- Be cautious of any request for sensitive information via text.

Enable Two-Factor Authentication (2FA)

- Secure your Chase account by enabling 2FA.

- This adds an extra layer of protection, requiring you to confirm your identity through a secondary method, such as a code sent to your phone or email address.

Use Security Features

Activate spam filters on your phone and consider using security apps that help detect and block phishing emails.

Monitor Your Accounts

- Regularly check your bank statements and transaction history for any unauthorised activity.

- Early detection can prevent further damage if your information is compromised.

Report Suspicious Texts

- Forward suspicious messages to Chase by sending them to 7726 (SPAM) and delete the text afterward.

- Reporting bank text message scams helps combat fraud and informs others of potential fraud.

Tools and Resources for Enhanced Protection

| Tool/Resource | Description | Benefits |

| Two-Factor Authentication (2FA) | An added security layer that requires a secondary form of verification | Protects accounts by adding an extra step for login |

| Spam Filters | Built-in or third-party filters for mobile devices | Helps block suspicious messages and reduce spam texts |

| Mobile Security Apps | Apps like Norton Mobile Security or McAfee Mobile Security | Detects and blocks phishing attempts and malware |

| Bank Apps | Chase app for secure transactions and communication | Allows direct, safe communication and alerts from a legitimate company |

| Fraud Reporting Services | Forward suspicious texts to 7726 (SPAM) | Helps report and prevent the spread of fake fraud alerts |

| Official Bank Websites | Chase’s official website for contact and updates | Provides accurate information and secure login options |

| Password Manager | Apps like LastPass or 1Password | Creates and stores strong, unique passwords securely |

| Encryption Apps | Tools like Signal for secure messaging | Ensures your messages are encrypted and secure |

| Regular Account Monitoring | Routine checks of bank statements and transaction history | Helps detect signs of fraud early |

| Phishing Awareness Training | Online courses or bank-provided training materials | Educates on identifying phishing and common scam tactics |

What’s Next?

Chase Bank alert text message spam poses a serious threat to your financial and personal security. By knowing how these types of scams work, recognising red flags, and implementing best practices, you can effectively safeguard yourself from falling victim.

Always verify suspicious emails through official channels, avoid clicking on phishing links, and never share sensitive information via text. Tools like two-factor authentication, mobile security apps, and spam filters further enhance your protection.

Additionally, staying informed and reporting fraudulent messages to Chase Bank or relevant authorities helps combat dangerous scam activity and protect others. Remaining cautious and vigilant is essential to ensure your accounts and personal data remain secure from evolving cyber threats.

Bytescare offers robust digital piracy monitoring, acting as your vigilant guardian against unauthorised content distribution. We swiftly detect and remove pirated copies, ensuring your creative work stays protected.

Safeguard your digital rights, maintain control over your content, and experience peace of mind. Contact us today for comprehensive content security!

The Most Widely Used Brand Protection Software

Find, track, and remove counterfeit listings and sellers with Bytescare Brand Protection software

FAQs

How to Identify Fraudulent Texts from Chase?

In fake text messages, look for red flags like generic greetings, urgent requests, suspicious links in texts, and poor grammar. Legitimate Chase texts will never ask for personal information or passwords. Always verify through Chase’s official website or customers support service.

How can you report Chase spam?

Forward suspicious texts to 7726 (SPAM) and contact Chase Bank directly via their customer service chat or the number on your card. Reporting helps them take action against bad actors and protect other customers.

How do I check my Chase Bank secure message?

Log in to your Chase Bank account through the official website or mobile app. Navigate to the “Secure Message Center” to access any official communications from Chase.

What should I do if I click on a link in a spam text?

Immediately disconnect from the internet, change your Chase Bank and related passwords, and contact Chase’s fraud department. Monitor your accounts for suspicious activity and report any unauthorised transactions.

Is Chase Bank responsible for reimbursing losses from scams?

Chase Bank may reimburse fraudulent transactions if they are reported promptly. Contact Chase’s fraud department immediately to investigate and determine eligibility for compensation.

How to protect yourself from Chase alert text message spam?

Verify banking scam text messages, don’t click unknown links, never share personal info, enable two-factor authentication, use mobile security apps, and report spam to 7726. Stay informed and monitor your accounts regularly for any unusual activity and prevent you from common bank scams.

Ready to Secure Your Online Presence?

You are at the right place, contact us to know more.