Key Takeaways:

- Safeguard your business against reputational risks with tailored insurance solutions, ensuring trust and customer loyalty.

- Brand reputation insurance covers costs related to crisis management, advertising campaigns, and recovery from negative publicity or environmental concerns.

- Build a proactive defense strategy to maintain brand integrity and thrive in an ever-changing, competitive marketplace.

The way people think of your business can change in a matter of seconds. Many months of work to earn customers’ loyalty can be lost in an instant with one bad review.

Not only does this harm brand reputation but it can also be very bad for their finances. That’s where brand reputation insurance comes in.

It’s like a safety net for your business. After a professional malpractice it’s not just about fixing the damage. It’s also about safeguarding your brand to come back stronger than ever.

This kind of insurance makes sure that your business can handle problems when they happen. It can cover financial irregularities that are linked to damage to the business reputation.

However, preventing ethical violations is only one aspect of it. By investing in brand reputational risk insurance you make it clear to your stakeholders that you value their trust. You will also do everything you can to keep your brand’s integrity.

We will talk about why brand reputation insurance is important in today’s uncertain world. We will also explore how it can help you protect your business’s most valuable asset: Your reputation. Let’s dive right in!

Protect Your Brand & Recover Revenue With Bytescare's Brand Protection software

What is Brand Reputation Insurance?

Protecting brands from the financial effects of reputational damage is what brand reputation insurance is all about.

A brand’s reputation can be ruined in an instant with a social media crisis or a legal problem.

As a safety net this insurance helps businesses rebuild trust after their reputation is damaged.

How Does It Work?

Most of the time brand reputation insurance covers the costs of handling a problem in addition to minimising its effects. This can include paying for court fees or hiring PR experts to deal with the media.

Some policies also cover paying for lost profits because of damage to the brand’s reputation.

If a food business gets negative publicity because of a problem with a contaminated product the insurance might pay for campaigns to get customers to trust the brand again.

Why Is It Important?

One of the most important things you have is your brand. If you damage it you could hurt your business’s reputation in the long run.

Having a brand reputation insurance policy will make sure you’re ready for the unexpected. As a result it can help you to focus on fixing the problem while keeping your costs as low as possible.

Why Your Business Needs Brand Reputation Insurance?

Reputation as a Business Asset

Your brand reputation isn’t just a nice-to-have—it’s a cornerstone of your success. A strong reputation helps people believe you. As a result it make more sales. It brings in new people while keeping old customers coming back. It gives you an edge in the market.

Risks to Brand Reputation

Unfortunately, your reputation is also fragile. A single public relations crisis can ruin your brand reputation right away. In the digital world even a small mistake can have an effect on your business in many ways.

Cost of Reputation Damage

The consequences of a damaged reputation can be devastating. It can cost money in the form of lost sales or more money spent on marketing to regain trust. In the long run it can hurt your market place.

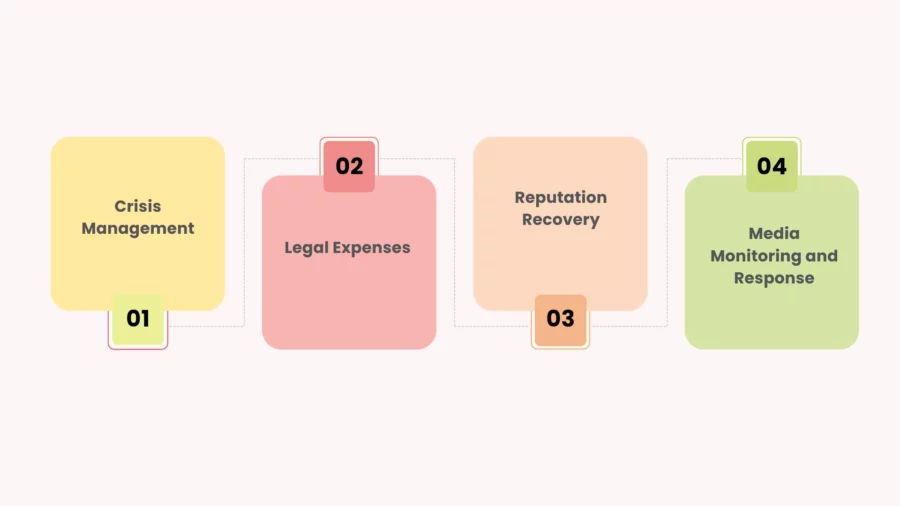

What Does Brand Reputation Insurance Cover?

Brand reputation insurance is more than just financial protection—it’s a comprehensive solution designed to help businesses manage, recover, and thrive after a reputational crisis. Here’s a closer look at what it typically covers:

Crisis Management

When a reputational crisis strikes, timing is everything. Brand reputation insurance provides access to expert PR and crisis management teams who can help you craft the right response, handle media inquiries, and control the narrative. This ensures that your message is clear, consistent, and aimed at minimising damage.

Legal Expenses

Defamation or libel suits can arise from negative publicity, whether justified or not. These situations often come with hefty legal fees and potential settlements. A brand reputation insurance policy covers these costs, allowing you to defend your brand without straining your financial resources.

Reputation Recovery

Restoring your brand’s image after a crisis is a long-term effort. This coverage includes resources to repair trust, such as running targeted marketing campaigns, engaging with customers, and rebuilding your public image. It ensures your brand can bounce back stronger and more resilient.

Media Monitoring and Response

Reputational threats often emerge online. Insurance policies often include tools to monitor social media platforms, news outlets, and forums for potential risks. Early detection allows for swift action, whether it’s addressing customer concerns or countering misinformation before it spirals.

Protect Your Brand & Recover Revenue With Bytescare's Brand Protection software

How Brand Reputation Insurance Can Protect Your Business?

Imagine a popular food brand hit by a product contamination scandal. Despite swift action, the news spreads, leading to a massive recall and a public backlash. The financial loss, combined with a damaged reputation, cripples the business.

With brand reputation insurance, the company could have covered recall costs, hired top PR professionals to manage the crisis, and launched campaigns to rebuild trust.

Similarly, a tech company accused of mishandling user data could have used insurance to fund legal defenses and customer outreach efforts, limiting the long-term fallout.

Cost-Effective Prevention

Dealing with the aftermath of a reputational crisis is expensive—lost revenue, legal fees, and marketing efforts to regain trust can quickly add up. Brand reputation insurance offers a cost-effective alternative by proactively preparing your business for potential risks.

It’s an investment that saves money in the long run, helping you respond quickly and effectively without derailing your operations.

Mitigating PR Disasters

When a PR disaster strikes, timing is everything. Insurance provides access to experienced PR firms that specialise in damage control. From crafting public statements to managing media relations, these experts work to control the narrative and minimise harm.

This safety net ensures you’re not navigating a crisis alone, allowing you to focus on keeping your business running.

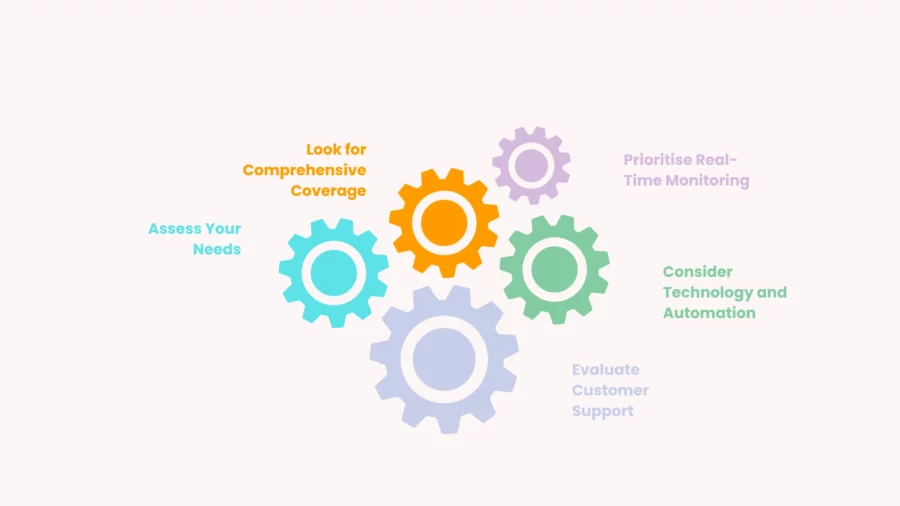

How to Choose the Right Brand Reputation Insurance?

Choosing the right brand reputation insurance is a critical step in protecting your business against potential reputational risks. But with so many flexible insurance coverage available, how do you find the right policy for your needs? Here’s what to consider:

Know Your Business Risks

Every business faces unique cyber incidents. A food brand might worry about product recalls, while a tech company could face cybersecurity breaches. Identify the risks specific to your industry and ensure the policy covers those scenarios.

Assess Coverage Options

Look for a policy that includes essential features like crisis management, PR services, legal expense coverage, and reputation recovery campaigns. Some policies even offer tools for media monitoring and early detection of potential threats, which can be invaluable.

Check the Limits

Know the policy’s coverage limits as well as any exclusions. Will it cover social media crises? What about legal fees for defamation lawsuits? Clarify these details upfront to avoid surprises during a crisis.

Look for Customisation

A one-size-fits-all policy might not work for your business. Opt for an insurer that offers customisable solutions tailored to your specific needs and industry.

Consider Expertise

Choose an insurer with expertise in reputation insurance. Read reviews and ask for case studies to gauge their effectiveness in brand damaging incident.

What Are the Benefits of Brand Reputation Insurance?

Financial Protection

Brand reputation insurance covers costs associated with crisis management, legal fees, and revenue losses, helping your business recover without straining finances.

Access to Crisis Management Experts

When a crisis hits, timing is everything. Insurance provides access to top PR professionals and crisis managers who can quickly craft the right response and control the narrative.

Reputation Recovery

Restoring a damaged reputation takes time and resources. This insurance supports campaigns and strategies to rebuild trust and strengthen your brand’s image.

Proactive Risk Management

With tools like media monitoring and early threat detection, you can address potential issues before they escalate, reducing the likelihood of significant damage.

Peace of Mind

Knowing you’re prepared for the unexpected allows you to focus on growing your business, confident that your reputation is protected against unforeseen challenges.

Protect Your Brand & Recover Revenue With Bytescare's Brand Protection software

What’s Next?

Your brand’s reputation is one of its most valuable assets. Protecting it through brand reputation insurance isn’t just a safety net—it’s a proactive step towards ensuring your business can handle any crisis that comes its way.

Whether it’s managing PR disasters, covering legal expenses, or rebuilding your image after a setback, this insurance offers the support and resources needed to safeguard your brand.

The benefits of reputation insurance are clear: financial protection, expert crisis management, and peace of mind. Investing in brand reputation insurance is an essential move for any business that wants to not only survive but thrive in an unpredictable world. Don’t wait for a crisis to hit—protect your brand today.

Your brand’s reputation is essential. Bytescare’s Reputation Management services use advanced technology and expert strategies to protect and improve your online presence.

From defamation scanning to content removal, we ensure your brand’s integrity stays intact. Contact us today to safeguard your reputation with a tailored strategy.

The Most Widely Used Brand Protection Software

Find, track, and remove counterfeit listings and sellers with Bytescare Brand Protection software

FAQs

What is Brand Reputation Insurance?

Brand reputation insurance protects businesses from financial losses due to reputational damage. Brand reputational risk insurance covers crisis management, legal expenses, PR services, and recovery campaigns, helping businesses manage and recover from cyber attacks that harm their reputation.

What is a brand reputation risk?

A brand reputation risk refers to any cyber breaches or security breaches that can damage the public perception of a brand. This includes negative press, social media backlash, product recalls, or legal issues, all of which can impact customer trust and loyalty.

How much does brand reputation insurance cost?

The cost of brand reputation insurance varies based on factors like business size, industry, and coverage level. Typically, premiums range from a few hundred to several thousand dollars annually, depending on the scope of protection needed.

Is brand reputation insurance available for small businesses?

Yes, brand reputation insurance is available for small businesses. Many insurers offer tailored policies for small businesses, providing affordable options to protect against reputational risks and ensure long-term success in a competitive market.

How quickly can a brand’s reputation be restored with insurance?

The speed of reputation recovery depends on the crisis’s severity. With insurance, businesses can access immediate PR support, crisis management, and recovery campaigns, which can help restore a brand’s reputation within weeks or months, depending on the situation.

Can brand reputation insurance cover social media-related crises?

Yes, brand reputation insurance can cover social media-related crises. Policies often include monitoring, rapid response strategies, and PR management to address negative posts, viral incidents, regulatory breaches or online defamation, helping to mitigate the impact on your brand’s reputation.

Ready to Secure Your Online Presence?

You are at the right place, contact us to know more.