Key Takeaways:

- Cease and desist letters can halt debt collector contact, but do not erase the underlying debt.

- Sending a cease and desist letter can help stop harassment and protect your rights under the Fair Debt Collection Practices Act (FDCPA).

- The letter should include your personal information, details about the debt, and a clear statement demanding the collector cease all communication.

Dealing with debt collectors can be tough, but you have strong tools to fight back. One of these tools is the cease and desist letter. It’s a formal request that stops debt collectors from contacting you under the FDCPA.

This letter doesn’t make the debt go away. But it does stop collectors from bothering you anymore. Once you send a cease and desist letter, collectors must stop calling or writing, except for one last call to tell you what they plan to do next. The FDCPA is a federal law that protects you from unfair treatment by these collectors.

Protect Your Brand & Recover Revenue With Bytescare's Brand Protection software

What a Cease and Desist Letter Is?

A cease and desist letter is a formal request for a debt collector to stop all contact regarding a specific debt.

The FDCPA shields customers against deceptive and abusive debt collection practices.

The FDCPA grants consumers the right to send a cease and desist letter to debt collectors, requesting they stop contacting them.

Legal Definition and Purpose

The purpose of a cease and desist letter is to set clear boundaries. It stops a debt collector’s attempts to contact the consumer about a debt. It’s a powerful tool to manage collection practices and protect consumers.

When to Use a Cease and Desist Letter?

Consumers can send a cease and desist letter in certain situations:

- The debt collector is being abusive, harassing, or deceptive.

- The debt collector is calling at a bad time or place.

- The debt collector is trying to collect a debt that’s already paid or not owed.

Protection Under the Fair Debt Collection Practices Act (FDCPA)

The FDCPA gives consumers specific rights and protections against third-party debt collectors. It limits the methods and tactics debt collectors can use. This includes limiting call times and stopping harassment.

When the FDCPA Applies

The FDCPA covers third-party debt collectors trying to collect personal debts. This includes credit card bills, medical bills, or student loans. It doesn’t apply to original creditors or business debts. Once a consumer sends a cease and desist letter, the collector must stop all communication, with some exceptions.

| Debt Collection Laws | Consumer Protection | Legal Rights |

|---|---|---|

| In general, debt collectors are not allowed to call before 8 a.m. or after 9 p.m. Debt collectors cannot contact individuals at work if their workplace prohibits personal phone calls. Debt collectors are constrained from discussing the debt with anyone except the debtor or their spouse. | FDCPA prohibits debt collectors from harassing consumers. Sending a Cease and Desist Letter can limit or stop communication with a debt collector. When sending a Cease and Desist Letter, the debt collector must cease contacting the individual except to confirm receipt or to notify of legal action. | Federal law requires debt collectors to stop contacting individuals upon receiving a written cease and desist letter. Individuals have the right to sue the collector for harassment if they continue to contact them after a cease and desist letter is sent. Individuals can file a debt collection complaint with the Consumer Financial Protection Bureau and the State Attorney General’s office if the collector does not cease contact after a cease and desist letter. |

Why You Might Need to Send a Debt Collector Cease and Desist Letter?

Dealing with debt collectors can be very stressful. There are good reasons to send a cease and desist letter. These include stopping calls for family debts, disputing debt validity, and managing financial issues.

If you’re in debt negotiations or thinking about bankruptcy, a cease and desist letter can help. It gives you time to think and gather information about the debt.

Debt collection calls can disrupt your work. Sending a cease and desist letter can protect your privacy. It lets you focus on your job without distractions.

“Over $1 billion has been protected from predatory debt lawsuits by the co-founder of SoloSuit, who graduated from BYU Law school in 2020 with a JD/MBA.”

The Fair Debt Collection Practices Act (FDCPA) protects you from debt harassment. A cease and desist letter can stop collection calls. It helps you regain control of your situation.

A cease and desist letter is a strong tool against debt harassment, collection calls, and financial hardship. Knowing your rights and taking action can help you find a solution that works for you.

Protect Your Brand & Recover Revenue With Bytescare's Brand Protection software

Essential Components of an Effective Cease and Desist Letter

When you write a cease and desist letter to a debt collector, it’s key to include all important parts. Your letter should have your personal info, details about the debt, and legal language to protect your rights under the FDCPA.

Required Personal Information

Begin by listing your full name, current address, and any other contact details. This makes sure the debt collector knows who to stop contacting.

Debt Account Details

Next, give details about the debt, like the account number and the amount owed. Don’t admit to the debt or give extra info. Use phrases like “the alleged debt” to protect yourself.

Clear Statement of Demands

The main part of your letter is telling the debt collector to stop contacting you about the debt. Say you want them to stop all form of communication and collection efforts about the debt. Make it clear that any more contact would break your rights under the FDCPA.

By including these key parts, you can make a strong cease and desist letter. It clearly states your legal rights and what you want the debt collector to do. This can stop annoying calls, letters, and other collection actions, giving you the peace of mind you need.

When to Send a Cease and Desist Letter?

Sending a cease and desist letter to a debt collector can stop unwanted contact. It’s a formal request for the collector to stop all communication about the debt. But when is the right time to send such a letter?

Consider sending a cease and desist letter in these situations:

- You’re being contacted repeatedly about a debt, even after asking them to stop.

- The debt is beyond the statute of limitations, meaning the collector can’t legally pursue it anymore.

- You’re disputing the debt’s validity, and the collector won’t validate the debt as required by law.

Timing is key when sending a cease and desist letter. For the best protection under the FDCPA, send it within 30 days of the collector’s first contact. This will make the collector verify the debt before they can continue.

If you’re unsure about the debt’s validity, send a debt validation letter first. This lets the collector prove the debt, helping you decide what to do next.

Understanding the debt collection timeline and your rights helps you decide when to send a cease and desist letter. Acting quickly and firmly protects you from unfair debt collection practices.

Protect Your Brand & Recover Revenue With Bytescare's Brand Protection software

Step-by-Step Guide to Writing Your Cease and Desist Letter

Writing a cease and desist letter for debt collection can protect your rights. It stops debt collectors from bothering you. This guide will help you write a strong letter, whether it’s for a debt collector or a collection agency.

- Gather the necessary information: Collect all relevant details about the debt, including the account number, the name of the debt collector, and the amount owed.

- State your purpose clearly: Begin the letter by stating your intention to cease and desist all further communication and collection efforts from the debt collector.

- Cite the FDCPA: Remind the debt collector of your rights under the FDCPA, which prohibits certain collection practices.

- Demand an immediate stop to communication: Firmly request that the debt collector cease all attempts to contact you, either by phone, mail, or any other means.

- Provide a deadline: Give the debt collector a specific deadline, such as 30 days, to comply with your demands.

- Threaten legal action: Warn the debt collector that failure to comply with your cease and desist letter may result in legal action, such as a lawsuit.

- Include your contact information: Provide your name, address, and any other relevant contact details to ensure the debt collector can easily respond to your letter.

Being clear, concise, and assertive is key to a successful cease and desist letter. Follow this guide to take control and stop debt collection activities.

Writing a cease and desist letter can seem hard, but it’s doable. With the right approach, you can clearly state your rights and demands. A well-crafted letter can help you regain control and protect yourself from harassment.

Sample Cease and Desist Letter Template

Below is a sample letter to request debt collectors to stop contacting you:

[Your Name]

[Your Address]

[City, State ZIP Code]

[Your Phone Number]

[Your Email Address][Date]

[Debt Collector’s Name]

[Debt Collector’s Address]

[City, State ZIP Code]Re: [Account Number or Reference]

Dear [Debt Collector’s Name or “To Whom It May Concern”],

I am writing to request that you cease all communication with me regarding the above-referenced account. Under the Fair Debt Collection Practices Act (FDCPA), 15 U.S.C. § 1692c(c), I have the right to request that you stop contacting me about this debt.

Please consider this letter as formal notice to cease and desist all further communication with me, except as permitted by law. Failure to comply with this request may result in me taking legal action to enforce my rights under the FDCPA.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Signature]

[Your Printed Name]

The Right Way to Deliver Your Cease and Desist Letter to Creditors

Sending a cease and desist letter to debt collectors can protect your rights. But, how you send it matters a lot. Certified mail with return receipt is best. It proves delivery, which is key if you need to take legal action.

Certified Mail Requirements

Certified mail with return receipt does two things. It shows the collector got the letter. And, the return receipt proves delivery. This is very useful if you have to file complaints or go to court.

Documentation and Record Keeping

It’s important to keep good records when dealing with debt collectors. Save copies of your cease and desist letter and the certified mail receipts. This evidence is crucial if the collector keeps contacting you after you’ve asked them to stop.

If you send the letter online, make sure you can prove the collector got it. This is important for your records.

By using certified mail with return receipt, you document your request well. This way, you have the proof you need to protect your rights if the collector doesn’t follow your request.

What Happens After Sending the Letter?

After sending a cease and desist letter to a debt collector, you might wonder what comes next. The results can differ, but knowing what might happen can guide you better.

The debt collector must legally stop all contact with you, except to confirm they got your letter or to warn you of legal steps. This means no more calls, texts, emails, or direct messages about the debt.

- If the collector follows your request and stops contacting you, the issue might be solved. You can then move on without more trouble.

- But, sometimes the collector might keep trying to reach out, either by mistake or on purpose. If this occurs, you can file a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s consumer protection agency.

If the collector decides to take legal action, like filing a lawsuit, you’ll need to act. This could mean getting a lawyer or preparing your defense. Keeping a record of all interactions and having a paper trail is crucial for your case.

| Potential Collector Response | Your Next Steps |

|---|---|

| Collector complies and stops contacting you | Matter may be resolved, continue monitoring for any further contact |

| Collector continues to contact you | File a complaint with the CFPB or state consumer protection agency |

| Collector pursues legal action | Respond appropriately, potentially hire an attorney, and document all interactions |

The cease and desist letter for debt collectors is a strong tool. But, it’s key to be ready for different outcomes and stand up for your rights if the collector doesn’t follow your request.

Remember, a cease and desist letter doesn’t erase the debt. But it can stop the debt collector from bothering you. Knowing your rights and the possible outcomes helps you deal with the situation better. It also protects you from more harassment.

Legal Rights and Protections During the Process

States offer more than just the FDCPA protections. Knowing your state’s laws is key to fighting debt collectors. Many states have laws like the FDCPA, even for the original creditors.

State-Specific Regulations

In Texas, the Debt Collection Act stops unfair practices. Debt collectors can’t ask for more than agreed upon, but they can add fees. Breaking the state’s Deceptive Trade Practices/Consumer Protection Act can lead to penalties and legal action by the Attorney General.

Consumer Protection Laws

Consumers can file complaints with the Consumer Financial Protection Bureau (CFPB) for FDCPA issues. You can also sue debt collectors for breaking the law. This could mean getting damages and lawyer fees. Knowing your rights and using the right laws is important during debt collection.

| Regulation | Key Provisions |

|---|---|

| Fair Debt Collection Practices Act (FDCPA) | Prohibits abusive, unfair, or deceptive practices by debt collectors Covers debts primarily for personal, family, or household purposes Restricts when and how debt collectors can contact consumers |

| State-Specific Debt Collection Laws | May offer additional protections beyond the FDCPA Can cover original creditors, not just third-party collectors Example: Texas Debt Collection Act prohibits abusive tactics |

| Consumer Financial Protection Bureau (CFPB) | Accepts complaints about FDCPA violations Consumers can file complaints and seek recourse |

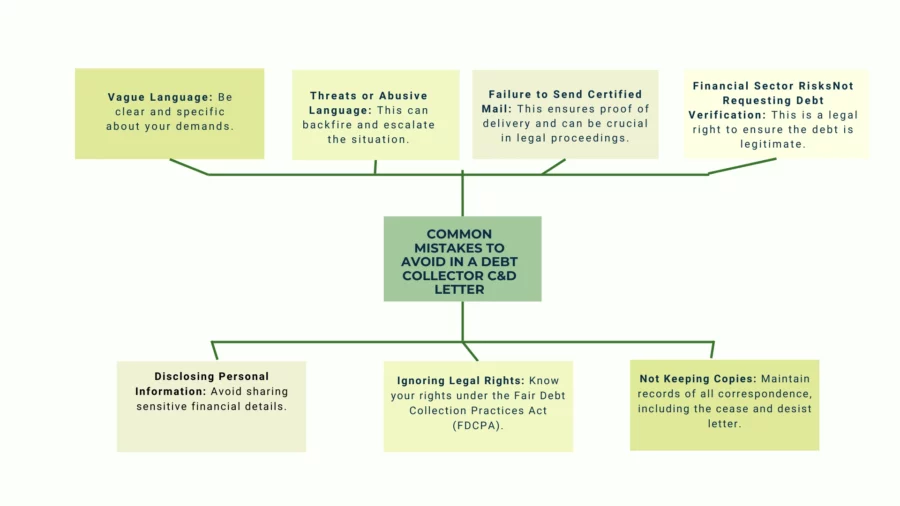

Common Mistakes to Avoid When Writing the Letter

When writing a cease and desist letter to a debt collector, it’s important to avoid common mistakes. One big mistake is acknowledging the debt by mistake. This could start the clock on the statute of limitations again, leading to more trouble. Also, don’t share more personal information or account details than you have to.

Another error to avoid is using threats or emotional language in your letter. It’s better to stick to the facts and clearly state your legal rights under the FDCPA. If you’re not sure what to write, getting legal advice before sending the letter is a good idea.

- Avoid acknowledging the debt, which could reset the statute of limitations

- Refrain from providing unnecessary personal information or account details

- Steer clear of making threats or using emotional language

- Stick to factual statements and assertion of your legal rights

- Consider seeking legal advice if unsure about the letter’s content or approach

By being careful and informed about the law, you can make your cease and desist letter more effective. This helps protect your debt acknowledgment, personal information, and legal rights.

“The Fair Debt Collection Practices Act is a powerful tool for consumers to protect themselves from harassment and abuse by debt collectors. By understanding the law and sending a carefully crafted cease and desist letter, you can take control of the situation and assert your rights.”

Alternative Communication Methods with Debt Collectors

You don’t have to stop talking to debt collectors altogether. You can tell them how you want to communicate. The FDCPA lets you choose when and where they can call or write.

Written Communication Options

Writing is a good way to deal with debt collectors. It makes a paper trail and proves your points. Use certified mail to send letters. This is great for talking about payment plans or debt negotiation.

Electronic Communication Guidelines

Debt collectors might try to contact you by email communication or other digital ways. But, they must follow the rules. They need your okay to email you and must give you choices to stop.

Using these methods helps you control the debt collection process. You can look into payment plans or debt negotiation. Always keep records and know your rights under the FDCPA.

“The key to managing debt collectors is to stay organised, document everything, and exercise your legal rights.” – Financial Advisor, Jane Doe

Taking Legal Action Against Non-Compliant Collectors

If debt collectors keep bothering you after you send a cease and desist letter, you can fight back. The FDCPA stops unfair debt collection. It gives you ways to defend yourself against FDCPA violations.

You can file a complaint with the CFPB, the Federal Trade Commission (FTC), or your state’s Attorney General. They look into FDCPA violations and can fine non-compliant collectors.

Another option is to sue the debt collector in court. The FDCPA lets you get up to $1,000 in statutory damages. You can also get actual damages and the collector’s attorney’s fees. Keep detailed records of all talks with the debt collector.

Think about talking to a consumer protection lawyer who knows FDCPA cases. They can check your case, tell you how strong it is, and help you through the legal steps. Going to court can stop the collector’s bad behavior and get you the money you deserve.

“Debt collectors who break the FDCPA can face lawsuits. This is a key way for consumers to fight back against unfair treatment.”

Remember, you have rights under the FDCPA. You don’t have to put up with unfair debt collection. By standing up and taking legal action, you can protect yourself. You also send a strong message to debt collectors that their actions won’t be accepted.

What’s Next?

Using a cease and desist letter is a strong way for consumers to manage debt collection. It doesn’t get rid of the debt, but it gives you more say in how it’s handled. Knowing your rights, writing a good letter, and understanding what might happen next can help you feel more in control.

It’s also important to tackle the debt itself. This can be through talking things out, combining debts, or going to court. Taking action and using the tools you have can help you deal with debt collection better. The cease and desist letter is just one part of taking back control of your finances.

Bytescare offers a suite of services to protect businesses from infringement and enforce digital compliance, making it ideal for dealing with trademark violations and other online threats. Book a demo today to see how we can safeguard your brand.

The Most Widely Used Brand Protection Software

Find, track, and remove counterfeit listings and sellers with Bytescare Brand Protection software

FAQ

What is a cease and desist letter to collection agency?

A cease and desist letter to a debt collection agency is a formal request asking them to stop all communication regarding a debt. This letter is often used when a debtor feels that they are being harassed, or when they believe the debt is inaccurate or invalid. Understanding your rights and the legal framework surrounding debt collection is crucial when dealing with collection agencies.

Can a cease and desist letter stop a debt collector from contacting me entirely?

A cease and desist letter to creditor can formally request them to stop all future communication with you. Once they receive this letter, they are legally obligated to cease contact, except for confirming receipt of the letter or notifying you of any specific legal action they intend to take. However, this does not eliminate the debt; it merely limits their communication methods.

What happens if a debt collector violates a cease and desist letter?

If a debt collector violates a cease and desist letter, they may be liable for legal repercussions under the Fair Debt Collection Practices Act (FDCPA). You have the right to sue them for damages, which can include actual damages and potentially statutory damages up to $1,000. It’s advisable to document any violations and consult with a lawyer to discuss your options for pursuing a claim.

Can sending a cease and desist letter to a debt collector affect my credit report?

Sending a cease and desist letter does not directly impact your credit report. However, it can influence how a debt collector handles your account. While the debt itself remains on your credit report, ceasing contact may prevent further collection efforts, which could mitigate future negative reporting. It’s crucial to remember that the debt is still owed, and collection efforts may resume if you do not resolve the issue.

What are my rights under the Fair Debt Collection Practices Act (FDCPA) when sending a cease and desist letter?

Under the FDCPA, you have the right to send a cease and desist letter to debt collectors, which requires them to stop contacting you. This law protects you from harassment and abusive collection tactics. Additionally, you can request validation of the debt, dispute inaccuracies, and file complaints against collectors who violate your rights. Understanding these rights can help you navigate debt collection more effectively.

Should I consult a lawyer before sending a cease and desist letter to a debt collector?

Consulting a lawyer before sending a cease and desist letter is advisable, especially if you’re unsure of your rights or the debt’s legitimacy. A lawyer can help you draft the letter appropriately, ensuring it complies with legal standards. They can also provide guidance on potential legal actions if the debt collector continues to contact you after receiving the letter, protecting your interests throughout the process.

Ready to Secure Your Online Presence?

You are at the right place, contact us to know more.